300x600

A six-figure salary can go a long way. Though it’s not enough to get you sipping on Moet and having lunch with Kylie Jenner, it’s without a doubt enough to live a very comfortable and stable life. So how exactly can you do it? What’s the magic formula to make a six figure salary in your twenties, or quite frankly, at any age? Although there’s not a one and done formula that can be replicated for every person, we’re breaking down what it really takes to earn a six figure salary, through what we’re calling the three steps to makin’ bank!

- The Basics

- The Plan

- The Hustle

THE BASICS

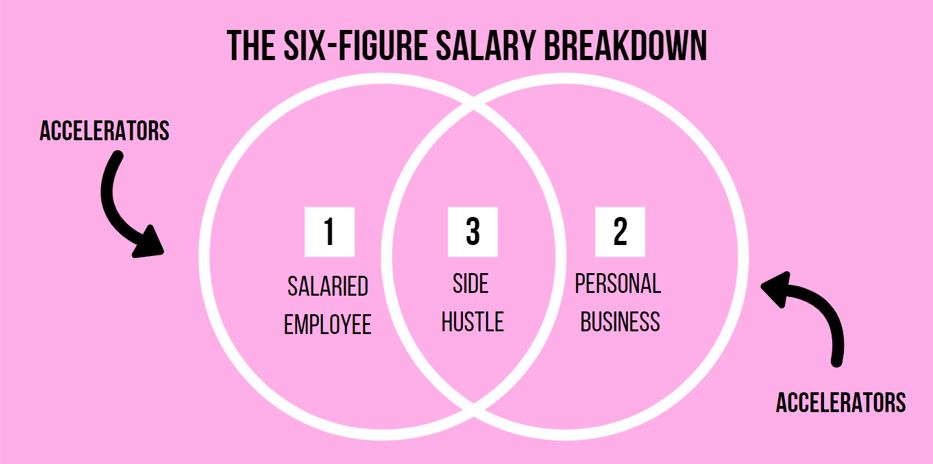

Let’s start with the diagram below.

When it comes to creating a six figure income, it’s fair to say there are 3 clear buckets:

Option 1: Salaried Employee

Think of this as getting a good and stable, high-paying job for a third party entity. i.e. climbing the corporate ladder, becoming an ER doctor at a hospital, etc. In other words, you’re working for someone else, but making serious bank (starting at well over $100k per year).Option 2: Personal Business

Let’s jump to the far right of the diagram. This is #entrepreneurlife – where you’re your own boss. If you run a personal business and can grow it to a great degree, you can make real cash money on your own. i.e. running your own successful online clothing store, opening up a restaurant that does really well, etc. (profiting enough to have a take-home salary of $100k per year). The key here, is running a successful business.

Option 3: Side Hustle

Now right in the middle, we’ve got the best of both. Let’s say you’re currently a salaried employee but you’re not quite there when it comes to your $100K per year goal. Perhaps you’re making a $50,000 / year income as a digital marketing consultant at an advertising agency. Just because you’re here, doesn’t mean you can’t dip into the Personal Business bucket. Here’s where you’ve got a mix of a stable income coming in, combined with your hustle. This grind is all about create several streams of income to get you to your desired yearly income. i.e. You may be a digital marketing consultant working 9-5 making $50K a year, but on the side you run your own blog / are an influencer, while also selling thrifted clothing on Ebay, bringing you another $50K of additional income a year.

Accelerators:

What should factor in to EVERY SINGLE plan are the growth accelerators that help you make that money that much faster. These are the must do’s to create passive income. In other words, where your money works for you, aka start investing your money ASAP to get rich.

THE PLAN

Now that we’ve sorted that through, the first step is to understand where you fit.

1. Based on your present-day situation, where do you best fit on that diagram?

- Are you a college student who has debt and needs to make a stable income? You’d likely start in Bucket 1 or 3, since the personal business will take time to scale.

- Are you a corporette who’s already making $80,000 / year and just needs to get a promotion at work for that extra $20K raise?

- Are you a stay-at-home-mom who needs to be home and can’t leave the house? Perhaps you have the option to build an at-home business and the ability to take on more risk due to a dual income household – maybe it’s in your books to shoot straight for Bucket 2.

Whatever bucket you’re in – you need to assess your situation and understand where you want to be and by when. Where you fit might change as time goes on. i.e. You may be a Corporette that starts in bucket 3. As time passes, perhaps your side hustle brings in enough for you to move straight into bucket 2, leaving your salaried job from bucket 1. Think of this as dynamic journey, but your starting point needs to be in one of the 3 buckets.

2. Time vs. Earnings & Risk vs. Reward

As part of your planning, you need to determine where you fit on the time vs. earnings, and risk vs. reward spectrum.

If you’re a new grad that has a ton of debt racked up, perhaps you can’t start immediately on the personal business grind because of how much time it takes to build up to a successful business. You’re likely more risk averse and need to take on a stable job for a stable reward. In other words, you might decide to go straight for a high-paying salary job. As time goes on and you build yourself a nest, you may decide you have enough financial backing to quit your job and start a small business full-time, with hopes to get a higher reward (knowing more risk is involved).

It’s so important to continually assess your life and financial situation to see what decisions you need to be making to optimize your potential earnings (and hit that six figure salary!).

THE HUSTLE

The last and final building block – is the hustle. Most people that earn a six figure salary won’t tell you they got there by chilling. Just like any milestone or accomplishment in life, getting to a six figure salary takes grit and hustle. Here are some of those fundamental must-do’s as part of your wealth-building journey:

- Vision and manifestation – if you believe it then you can achieve it, ’nuff said! Keep your goal top of mind. Whether that means creating a vision board, writing yourself sticky notes, or telling yourself every single day “I will and I can make a six figure salary” – vision is key.

- Goal setting and mini plans – Here’s how to actually achieve your goals. If making a six figure salary is one of them – then follow these little hacks to develop habits to make it happen. As much as visioning is important, you need to action and execute to turn those dreams into a reality.

- Determination: Got knocked down? Better get up again. Whether you just got rejected for getting a raise at work, or your side hustle is just not growing, DO. NOT. GIVE. UP. Nothing in life comes easy. Determination is the core of the hustle – you gotta strive to thrive!

- Aptitude: There will be many points where you need to test, learn, and pivot based on what you’re doing. Whether that means knowing when to change jobs from one company to another because you’ve reached your salary ceiling, or revamping your personal business brand because you’ve hit a slump in sales – stay keen and stay smart. To keep growing, you need to keep changing, and to hit that six figure salary you need to expect to hit a number of obstacles and challenges. The key is to have the aptitude to understand what needs to change / what you should be doing better, to land where you ultimately want to be.

If anyone can do it it’s you. Time to make those money moves!

0 Comments